Banks are one of the most technologically advanced industries in the world. This applies to both the digitalization of services and solutions of players and the approaches of companies to the promotion and development of business in general. Users are actively responding to market trends and switching to digital services, which allow them to solve daily tasks faster and easier. Advertisers study the needs of the audience and develop new approaches to communication with customers. Social media and targeted advertising are popular channels in the banking category that allow you to differentiate yourself from competitors and avoid an overheated auction in traditional PPC advertising. All these technologies and trends are united by banking software development.

Types of Banking Software:

- Classic Bank-Client (fat client, remote banking, home banking). A separate client program is installed on the user’s computer, which immediately stores all its data (account statements, payment documents). Interaction with the bank can be carried out through various communication channels (telephone dial-up or dedicated lines, via the Internet).

- Internet banking (Internet client, thin client, Online banking, Internet banking, WEB-banking) is a remote banking system that works through a regular Internet browser. With its help, you can carry out all the same actions as through traditional systems, with the difference that the installation of the system distribution kit on the user’s computer is not required. For more information, see Internet banking.

- Mobile banking (telephone banking, SMS banking) is the provision of services using telephone communications. As a rule, such systems have a limited set of functions. Most often this is an information service (account statements, account balances, etc.). But some banks allow customers to make various payments and make money transfers using a mobile phone.

- External services – technologies using self-service banking devices (ATMs, payment terminals, information kiosks).

All these technologies belong to the financial software development sector. Very strict safety standards have been adopted in this area. Therefore, when choosing a development team, be sure to pay attention to the technologies that the team uses to ensure the secrecy of transactions.

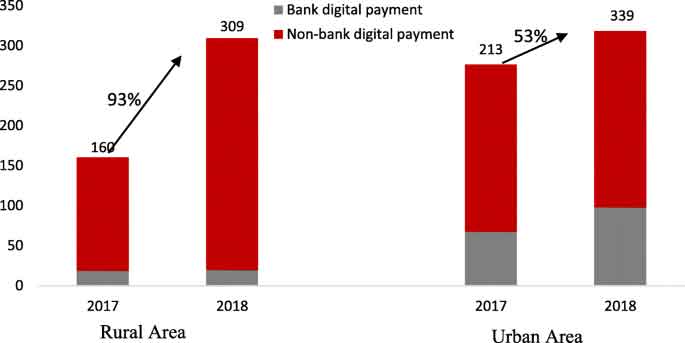

Some Statistics

More than 90% of residents of developed countries actively use online banking services, 81% of them choose a mobile application, and 54% – a web version. Users choose Internet banking primarily for solving three main tasks: transferring money, paying for services (65%), and controlling expenses. These numbers once again confirm that any business in the financial sector must use mobile and web development.

Output:

The growth in the number of users of digital banking services is beneficial for both the banking community and consumers of banking services. On the other hand, problems with low digital literacy of certain categories of users of financial services make it difficult to obtain these services through digital channels. Banks need to strive to make these services more accessible, and additionally work to protect the personal data of customers.

Follow TechStrange for more Technology, Business, and Digital Marketing News.